The buying process

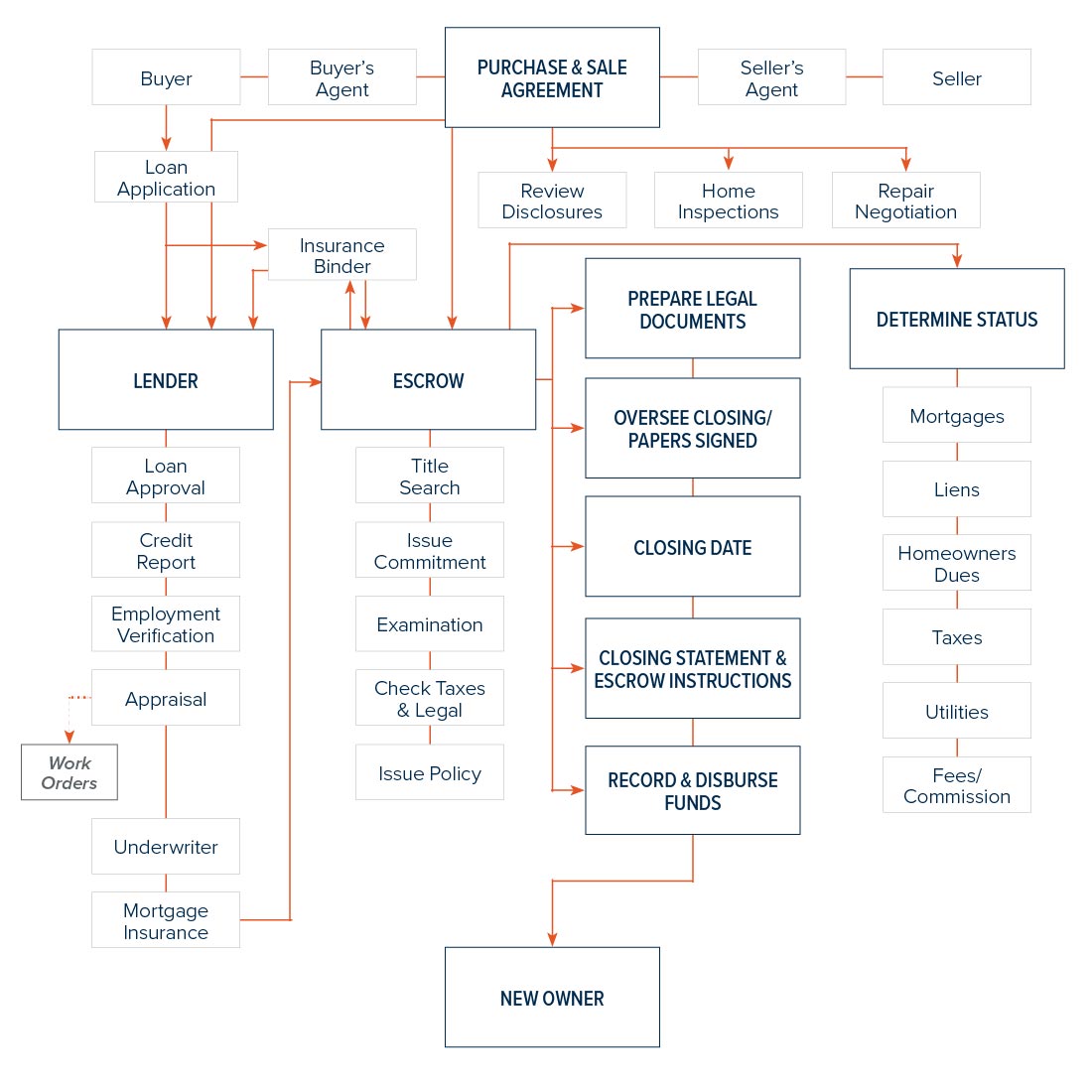

STEPS TO CLOSING

Once an offer on a property has been made by a buyer and accepted by the seller, they enter into a legal contract known as a Purchase and Sale Agreement. This document outlines the specific terms and conditions of the transaction and is acknowledged by both parties by the signing of the document.

Once a buyer and seller reach mutual acceptance on a property, a home inspector is hired to investigate every nook and cranny to determine if the home is in need of any repairs. An inspector will check items, such as the roof, basement, heating system, water heater, air-conditioning system, structure, plumbing, and electrical. Afterwards, buyers will have a chance to negotiate with the sellers to cover the costs of certain repairs or to ask for concessions.

Whether you’re a buyer or a seller, negotiation is the key to getting the best deal. Negotiations can involve everything from settling on a sales price to concessions and financing. Windermere Real Estate agents are expert negotiators whose job it is to represent your interests during the give and take of a real estate transaction.

You may already be pre-approved, but now that you’re closer to the actual purchase price, you’ll be working more in-depth with your lender on your final loan approval. To learn more about this process, pay a visit to our Mortgage Center.

You will receive a full report detailing the property history for you and your lender to ensure there are no legal encumbrances between a new owner and the property being purchased.

Once the offer is accepted and a closing date agreed upon, escrow allows the buyer and the seller to have an outside party ensure all parts of the contract are complete. Your Windermere agent can help coordinate the completion of all necessary forms to the escrow company and monitor the escrow process until the transaction is complete.

At closing, all the paperwork is signed by the buyer and seller, both parties pay any settlement fees and the documents are officially recorded. Prior to closing, you'll receive a settlement statement outlining any fees which may apply to you. After closing is finalized and recorded, the home is yours!

CALL US DIRECT 425-672-1118 TO REQUEST AN AGENT

Why Windermere Edmonds?

We know the local market and can quickly narrow it down to a few areas where you are likely to find the home you want at a price you can afford.

We can save you time by doing a lot of the legwork. By knowing your needs, we can eliminate homes that do not meet your criteria. We will make appointments, preview homes with you and help you determine the pros and cons of each home.

Windermere Edmonds is a member of the Multiple Listing Service (MLS), which enables us to learn about new listings from all participating brokerages as soon as they hit the market. Our agents also interact with one another on a daily basis to share information about new properties and match eager buyers with the right homes.

We can help you maximize online home search tools available to you on WindermereEdmonds.com.

We can provide information and make appointments to see almost any property listed for sale. A home does not have to be listed by a Windermere Edmonds agent in order for me to get detailed information or an appointment to view.

Once you find the home you want to buy, we will guide you through the negotiation, legalities and details of purchasing a home.

How much can you afford?

In order to plan properly, you need to understand what lenders are looking for from a borrower. There are three factors that help determine if you qualify for home financing:

Most loan programs require you to verify all of your income sources. Your mortgage consultant will let you know what documentation is needed. Typically, you will need to provide pay stubs and your W-2, and if you are self-employed, you may need to provide copies of your tax returns.

An asset is anything your own with economic value, such as investments or vehicles.

All lenders review a borrower’s credit history to determine the type of credit used, the amount owed and the borrower’s history of repaying debt.

Mortgage options

CURRENT INTEREST RATES

OR ENTER YOUR INFORMATION BELOW TO GET CONNECTED: